Northland Foundation offers flexible loan options for businesses in northeastern Minnesota

Northland Foundation offers flexible loan options for businesses in northeastern Minnesota

Having access to enough capital to start a business, keep it going through tough times – as many are experiencing now – and grow it when the opportunity comes, is critical to our regional economy. The Business Finance Program of the Northland Foundation was created 34 years ago to help businesses get the financing they need to start, sustain, and expand.

In the early 1980s, manufacturing, Iron Range mining, and other natural resources industries were hit hard. Today the coronavirus pandemic and its impacts on the economy are taking a toll once again.

One of Northland’s top priorities then and now is improving access to loan capital for small businesses. The foundation partners with businesses, banks and credit unions, and other development lenders to bridge lending gaps. To date, Northland has lent more than $66 million, helped leverage $350 million

more for more than 600 borrowers, and supported the creation or retention of 8,000 jobs.

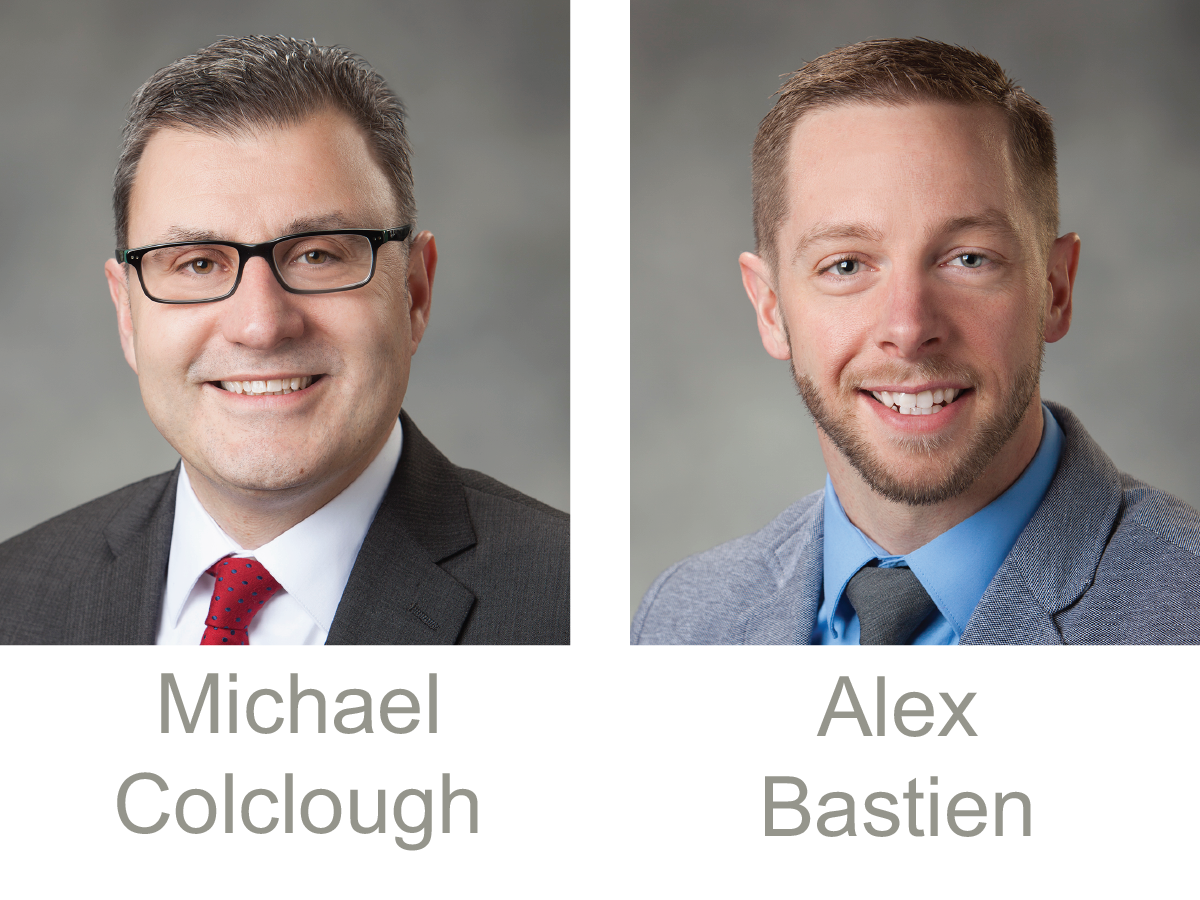

“There is a great cooperative environment in northeastern Minnesota, with local agencies working together to provide loan packages that best suit the borrower business.” says the Business Finance Director, Michael Colclough.

“There is a great cooperative environment in northeastern Minnesota, with local agencies working together to provide loan packages that best suit the borrower business.” says the Business Finance Director, Michael Colclough.

Over time, the Northland Foundation has met the changing needs of borrowers and banks with different tools. As a certified SBA lender, Northland can finance SBA loans directly or with other partners. The foundation is also a participant in State of Minnesota Emerging Entrepreneur Loan (EEL) and Loan Guarantee programs. EELs promote economic development in lower-income areas of the region and among enterprises owned by minorities, women, veterans, people with disabilities, and people with low incomes. Working with a borrower’s bank, the foundation’s Quick Turn Loans can turn around up to $150,000 matched or exceeded by the bank within a few days.

“We can take more risk than a traditional lender might. We work with other partners as well as making some direct loans, especially for start-ups that may not be bankable yet,” added Michael Colclough.

CAST Corporation in Hibbing has been a manufacturing/fabrication repeat client. CAST machines parts and produces custom ferrous castings. Tim Bungarden started out in a small, rented facility on the Iron Range 26 years ago but has greatly diversified and expanded. In 2005, he bought a site in Hibbing with plenty of room for expansion. In 2010, he doubled the machine shop size and added a foundry in 2014.

At each turning point, Northland, Security State Bank, and others such as Iron Range Resources & Rehabilitation have been there. In 2019, Tim came back to Northland and Security State Bank to refinance an existing loan, providing working capital to aid in the growing demand for foundry work.

“When you start out as an entrepreneur and you are under-capitalized, that’s really important to have that assistance, where it is a shared risk – some of it entrepreneurs, some of it banks, and some of it agencies like Northland Foundation,” said Bungarden.

To learn about the Northland Foundation’s small business assistance, email Michael Colclough, the Director of Business Finance, or Alex Bastien, Loan Portfolio Manager or visit www.northlandfdn.org.